Drive SaaS revenue in emerging markets with smarter payments and collections

Challenges

Breaking barriers to SaaS growth in emerging markets

When expanding into emerging markets, SaaS companies may miss critical payment challenges that impact growth. Payment failures, especially with recurring transactions, can disrupt revenue flow and impact customer loyalty. Manual payment reconciliation processes create inefficiencies and delays. On top of that, missing the right local payment methods can affect conversion rates. Other challenges include:

- High cross-border payment rejections

- Expensive transfer costs and delays

- Recurring payment inefficiencies

- Limitations from international acquirers

- Error-prone manual invoice reconciliation

- Region-specific regulation challenges

Solving payment roadblocks with local acquiring and processing

Managing a SaaS business across emerging markets, whether subscription-based, high-ticket, or transactional, requires solutions catering to local payment needs.

With a platform that offers access to over 900 local payment methods, you can address currency conversion challenges, simplify compliance, optimize cash flow, and reduce fees. This will help improve transaction efficiency and reduce payment delays, providing a more localized experience for users.

Explore our solutionsPowering payments for industry leaders

dLocal solutions for SaaS

Payins: Offer your emerging market shoppers a seamless and secure payment experience.

Interested in Payins?

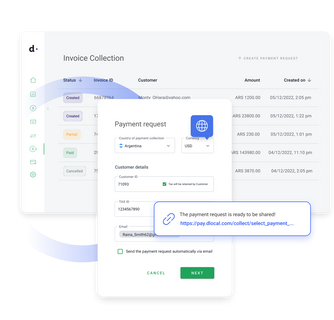

Invoice Collection: Streamline your payment collection process

Allows for local currency payments, addresses challenges related to local regulations and currency fluctuations, and enables easy funds transfer for merchants.

Defense Suite: Manage fraud effectively

A comprehensive fraud management solution that allows global eCommerce companies to compliantly minimize financial loss and enhance customer reputation.

Payouts: Pay your sellers/stakeholders in the method and currency of their choice and streamline your payouts process.

Interested in Payouts?Crafted for your growth: payment solutions for SaaS

Keep revenue steady while expanding into emerging markets with efficient cross-border transactions. Boost your approval rates and transaction reliability with Smart Routing and Smart Requests, while Network Tokenization strengthens your security and reduces fraud risk.

With a single API integration, gain access to +900 local payment methods, manage multi-currency support, ensure regional compliance, and track real-time analytics to scale your SaaS business without increasing complexity.

Use Cases

Real world impact

Fourvenues, an event management SaaS platform, partnered with dLocal to expand into LATAM and Southeast Asia, known for its fast-growing event and entertainment industries. To support this expansion, Fourvenues started offering a variety of alternative payment methods, including cash, bank transfers, eWallets, and mobile money. This includes PSE and Nequi in Colombia; OVO, ShopeePay, and Dana in Indonesia; FPX in Malaysia; and other local options in Chile, Costa Rica, Uruguay, Ecuador, the Philippines, and Thailand. The integration has also supported growth in these markets by offering contactless payment methods.